Dec 25 2009 4. Kekurangan Simpanan Melalui Fixed Deposit.

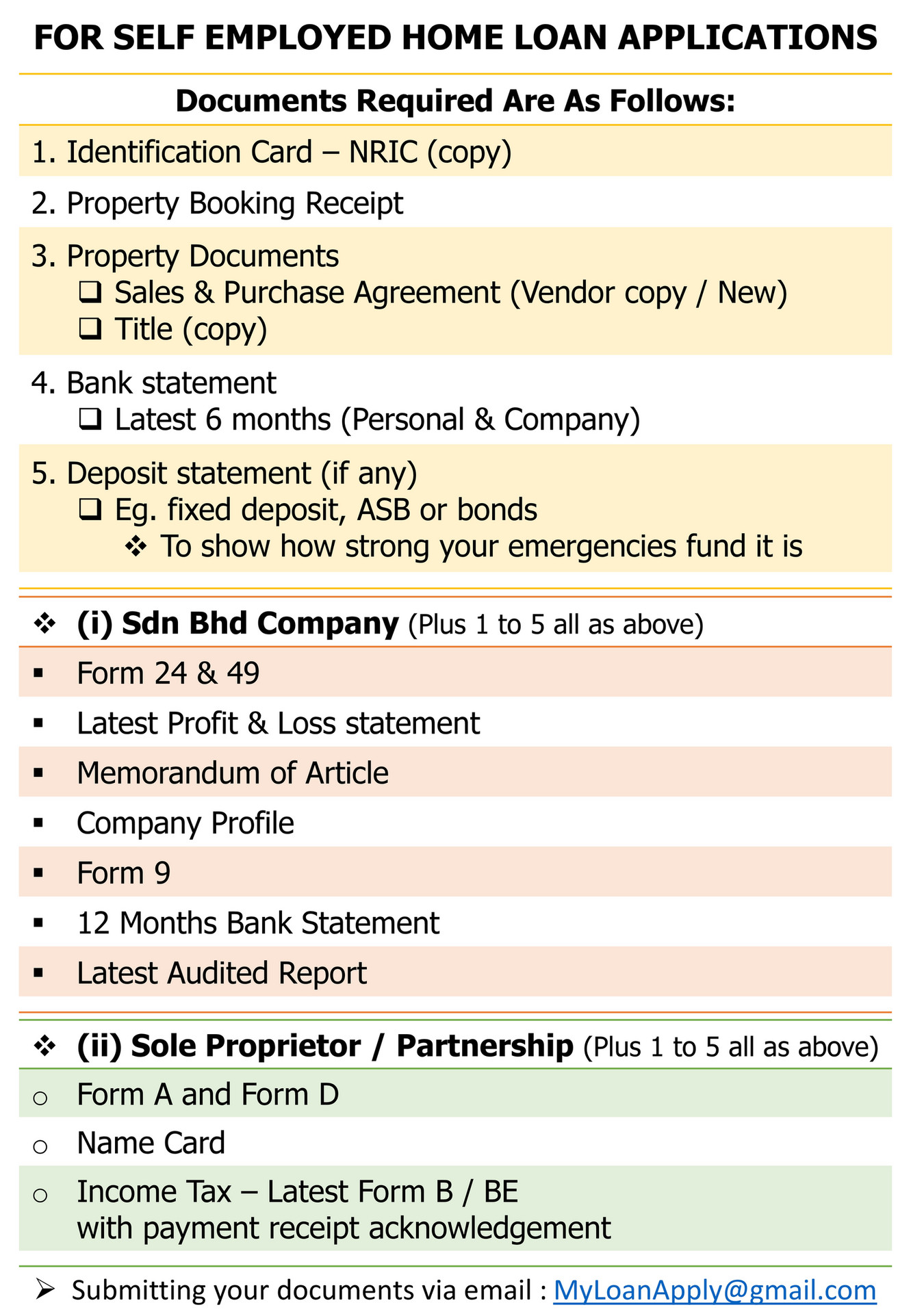

Good Buy For Self Employed Home Loan Applications Documents Required Page 1 Created With Publitas Com

Debentures and fixed deposits are two different ways of investing money through relatively low-risk financial instruments.

. ASB was launched by Amanah Saham Nasional Berhad ASNB on 2nd January 1990 for all Malaysian Bumiputeras. Both RDs and FDs can be opened online using mobile banking apps or net banking. It aims to generate long term consistent and competitive returns for investors.

Interest rates shown are for six-month tenures. Fixed Deposits that are made for. Unlike ASB and ASB 2 funds each individual can invest up to 200000 units only excluding re-investment of distributions.

According to ASBs annual report heres how its assets are allocated. Types of Fixed Deposit and Mutual Funds. The funds objective is to provide an alternative savings vehicle for Malaysian Bumiputeras.

Fixed Deposit Simpanan Tetap adalah merupakan salah satu instrumen kewangan yang ditawarkan oleh institusi perbankan. Tetapi akan datang tidak pasti boleh jadi jika dividen ASB semakin rendah mungkin ramai pada masa itu akan. These savings vehicles allow you to put funds away for a set period of time.

So if your income tax rate is more than 28 during the term of your deposit you could get a better. Dari segi dividen setakat ini memang ASB lebih tinggi berbanding dengan FD. Choose when your interest is paid.

Gaya pelaburan ini adalah yang paling mudah sekali. The amount on fixed deposits is locked in for a set period of time whereas the amount on recurring deposits must be deposited every month for a set period of time. 5 Kelebihan Simpanan Melalui Fixed Deposit.

With an ASB Term Fund your share of income earned by the ASB Term Fund is taxed at your Prescribed Investor Rate PIR of 0 105 175 or 28. Kebanyakan bank ada menyediakan kemudahan fixed deposit FD untuk pelanggan. Furthermore if you scroll way below you will also see a real example of an ASB account making 6 figures in net profit keuntungan pelaburan 6 angka caya la jangan main main In short this is your ultimate.

In fact banks sometimes use the terms interchangeably. Money is kept for a fixed residency. HiI do not know whether this is the right place to ask and i would like to apologize firstAs per topic description.

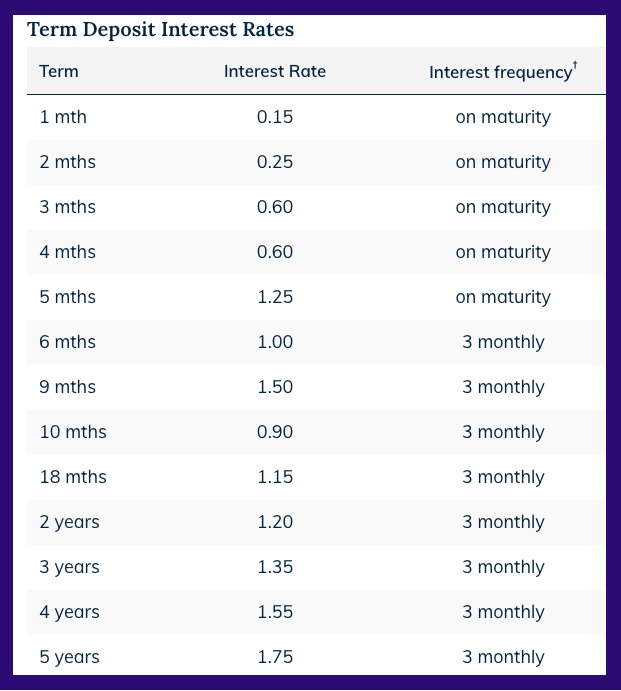

You can open a term deposit with a minimum deposit of 5000 and you can choose a term from 30 days to five years. Kalau ikut jadual kat atas simpanan ASB Johan akan dapat sebanyak RM115500 tapi pinjaman ASB korang akan dapat RM117622. ASB Financing nih apa pulak.

Minimum 5 in cash or liquid assets. ASB ini lebih fleksible berbanding dengan FD. A savings account is continuous whereas a fixed deposit account is a one-time investment for a particular period.

Accurate as of January 2021. Tenure can go from 7 days to 10 years. Singapore Savings Bonds SSB Savings Account Interest rates December 2020 02 per cent 13 per cent pa.

Ia menjanjikan pulangan faedah tetap yang lebih tinggi berbanding simpanan akaun biasa. Beza sebanyak RM2122 walaupun jumlah ekuiti sama je kedua-duanya sebanyak RM200000. As such ASB was designed as a fixed price equity income fund.

ASB 3 Didik fund in substance is no different from ASB and ASB 2 funds. Fixed Deposit VS ASB. You can also manage your investments online to bank when and where it suits you.

Amanah Saham Bumiputera Amanah Saham NasionalorFix deposit. A portion of the highlights are. Di sini penulis ingin kongsikan beberapa alternatif yang kita sama-sama boleh terokai.

A debenture is an unsecured bond. Depending on the term interest can be paid quarterly six-monthly annually or at the end of the term. Sekiranya anda nak buat simpanan tetap sebulan tak digalakkan untuk buat simpanan di FD.

Up to 90 of in equities. Jun 1 1200 AM. Banyak bank yang menawarkan produk fixed deposit ada yang.

Secara ringkasnya anda hanya memberikan wang anda kepada. Malah ada juga yang sering membandingkan antara Tabung Haji vs ASB Amanah Saham Bumiputera mungkin kerana kedua-dua tempat ini merupakan tempat simpan duit yang menjadi pilihan kebanyakan orang. These accounts dont offer tax savings.

Amanah Saham Bumiputera 3 Didik or ASB 3 Didik fund. The good news is there is no maximum limit that you can invest in ASB 3 Didik fund. Savings Accounts dont have lock-in periods.

Fixed Deposit Simpanan Tetap atau Time Deposit. Money can be withdrawn from a savings account whereas a fixed deposit account does not allow this. With a term deposit your interest is taxed at your income tax rate.

ASB1 dan ASB2 apa beza dia. As of end 2020 8198 of its portfolio was allocated to equities 774 to fixed income investments and 1028 in other investments. MANA BAIK LETAK DUIT DLM FIX DEPOSITFD ATAU ASB.

Which is better if i got sum of money and only those two option available for me to keep the money while giving me return on keeping it there and with no riskASBASN. 027 per cent 164 per cent pa. Senang cerita selagi kadar dividien korang tinggi dari kadar interest pinjaman korang masih buat untung sikit.

Banks provide recurring deposits and fixed deposits as ways to encourage individuals to save. How the investment is taxed. There are a few minor differences between a certificate of deposit and a fixed deposit.

Using the banks fixed deposit rate of 185 per cent compounded monthly the total interest earned is around 142560 by February 2021. Fixed deposit laddering is a strategy that spreads out your money across different tenures this gives you more flexibility when accessing your money and helps you take advantage of the best rates. Takpe tengok je video nih sampai habis baru faham Learn more.

BTC USD Gold USD. Up to 50 in other asset classes. Average return of of 090 per.

BTC USD Gold USD. The rate of revenue is predetermined by the bank. Because this ASB Financing Guide is evergreen relevant in 2019 2020 and beyond whether you are taking ASB loan 30k 50k 100k or 200k.

FD - dah tetap fixed 2-3 percent je setahun ASB - tak tetaptapi average 7-8. Essentially it is a bond that is not. Baiklah dalam artikel kali ini saya akan tulis berkenaan hal-hal di atas.

New posts Search forums. A savings account has a low minimum balance whereas a fixed deposit account has a higher minimum balance. Most banks offer tax-saving Fixed Deposits meant to help customers save on income tax under Section 80C.

Following are the types of Fixed Deposit and Mutual Funds. The total interest earned is only around 1203 a difference of around 222. Jun 1 1200 AM.

New posts New blog entries New blog entry. Standard Fixed deposit - It is the standard FD plot accessible at all banks. Nadeyya Rahmat July 19 2018 759 am.

However if you use the SSB and withdraw on the third year you have the equivalent interest of 16 per cent per annum.

Breaking A Term Deposit Banking Ombudsman Scheme

Icu Nurse Report Sheet Etsy Icu Nurse Report Sheet Icu Nursing Nurse Report Sheet

Investing Money Wisely In Fixed Deposit Investing Money Investing Investment Quotes

Business Certificate Of Deposit Cd Hawaii American Savings Bank Hawaii

Bonus Saver Vs Notice Saver Vs Term Deposit Which Savings Product Is Right For You Money King Nz

Are Fixed Deposits Still Worth It In 2021

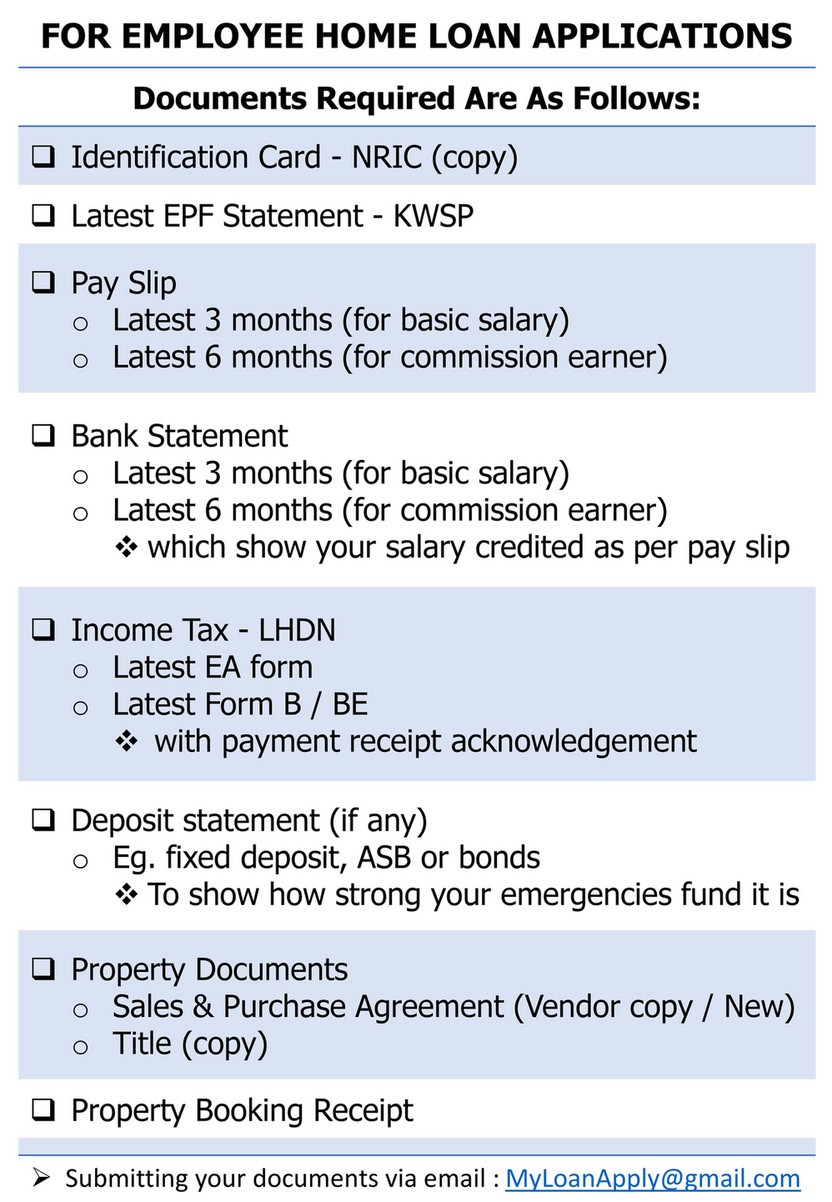

Good Buy For Employee Home Loan Applications Documents Required Page 1 Created With Publitas Com

Safelok 12x16 Clear Deposit Bag Carton

Asb Financing Pinjaman Asb Wealth Deposit Campaign Cash Investment With Fixed Deposit Fd Return 28 For 1 Month 1 Fixed Deposit 1 Asnb Vp Minimum Amount

All Fellow Blondes Know The Eternal Struggle Of Maintaining The Perfect Blonde Tone Give It A Few Weeks Toning Blonde Hair Ash Hair Color Blonde Hair At Home

Should I Put Money Into Asm Or Fixed Deposit R Malaysianpf

Rate Of Return Of Fixed Deposit And Asb Download Table

How To Make An Atm Deposit Cash Or Check Gobankingrates

Rate Of Return Of Fixed Deposit And Asb Download Table

Central Pacific Bank On The App Store